How Slow-Paying Clients Quietly Kill Contractor Cash Flow (And What to Fix)

Contractor Pain Point

You finish the job.

The crew is paid.

Vendors are paid.

Subs are paid.

But the client hasn’t paid. On paper, the job shows profit. In the bank, cash is tight.

So you:

Delay equipment purchases

Stretch vendor payments

Use your line of credit

Push owner draws

It feels like a client problem. But most of the time, it’s a system problem. Slow-paying clients don’t usually create the issue. They expose weaknesses in your billing, job setup, and collections process.

If you’re unsure whether the issue is client behavior or structural cash timing, start with the Job Costing Health Report. It helps identify when profitable jobs are starving cash because billing and cost timing don’t align.

Why This Happens (It’s Usually Structural)

Cash flow problems rarely start with one bad payer.

They build because:

Billing milestones don’t match cost exposure

Invoices go out late

AR isn’t reviewed weekly

Collections don’t follow a defined process

Reporting hides aging trends

When your receivables stretch from 30 days to 45… then 60… then 75… You are financing the project. And if you don’t actively manage it, growth makes it worse.

If AR processes are loose, revisit:

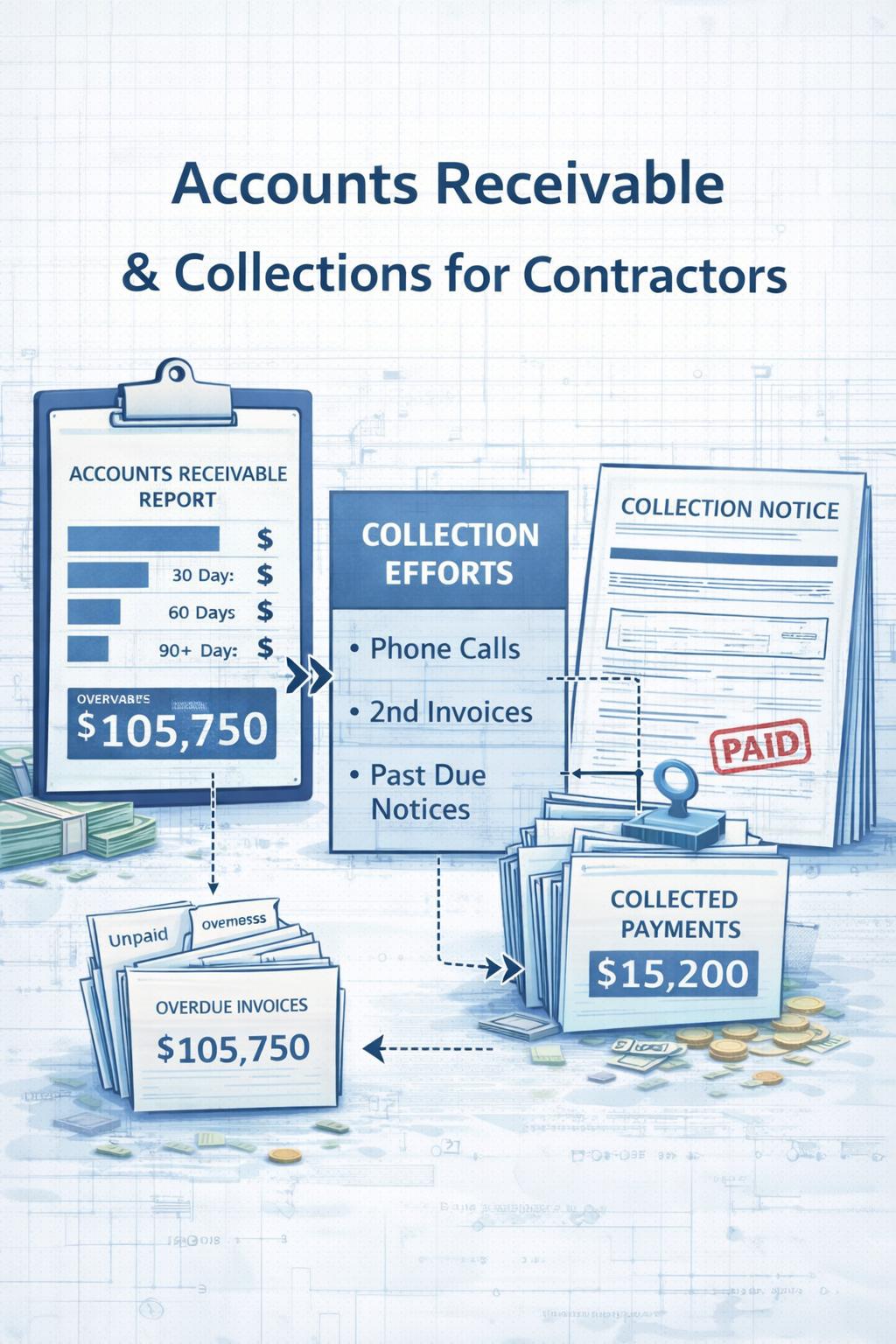

Accounts Receivable & Collections for Contractors

Collections are not about chasing clients. They’re about enforcing structure.

Step-by-Step: How to Protect Contractor Cash Flow

1. Align Billing Milestones With Cost Exposure

What to do:

Structure invoices around when major labor and material costs hit.

Example:

40% deposit before mobilization

30% after framing

20% after rough-in

10% at completion

Why it matters:

If you front-load labor and materials but invoice later, you operate negative cash flow even on profitable jobs.

What goes wrong if skipped:

Your line of credit becomes your working capital source.

If billing and cost timing feel disconnected, the Job Costing Health Report can quickly reveal where the imbalance is happening.

2. Invoice Immediately — Not at Month-End

What to do:

Invoice the same day a milestone is completed.

No batching.

No “we’ll send them Friday.”

No waiting until close.

Why it matters:

If you delay invoicing by 10 days and the client pays in 30, your cash cycle becomes 40 days. Across multiple jobs, that’s significant strain.

What goes wrong if skipped:

Cash lag compounds silently.

3. Review AR Weekly (Non-Negotiable)

What to do:

Run an AR Aging Summary every week.

Focus on:

Over 30 days

Over 60 days

Retainage balances

This ties directly into your reporting structure. If you don’t have a clean close process, review:

Monthly Close Checklist for Contractors (The Control System Most Shops Skip)

Why it matters:

You can’t collect what you don’t consistently see.

What goes wrong if skipped:

You discover problems only when payroll feels tight.

4. Define a Clear Collections Workflow

What to do:

Day 1 past due: Friendly reminder

Day 7: Direct follow-up

Day 15: Escalate internally

Pause work if contract allows

This isn’t aggressive. It’s procedural.

For a full breakdown of process structure, see:

Accounts Receivable & Collections for Contractors

Why it matters:

Clients pay faster when systems are predictable.

What goes wrong if skipped:

Your team hesitates to follow up — and invoices age unnecessarily.

5. Stop Increasing Exposure on Overdue Accounts

What to do:

Do not continue work on severely overdue accounts unless contractually required.

Why it matters:

Continuing work trains clients that terms are optional.

What goes wrong if skipped:

You deepen exposure on the highest-risk accounts.

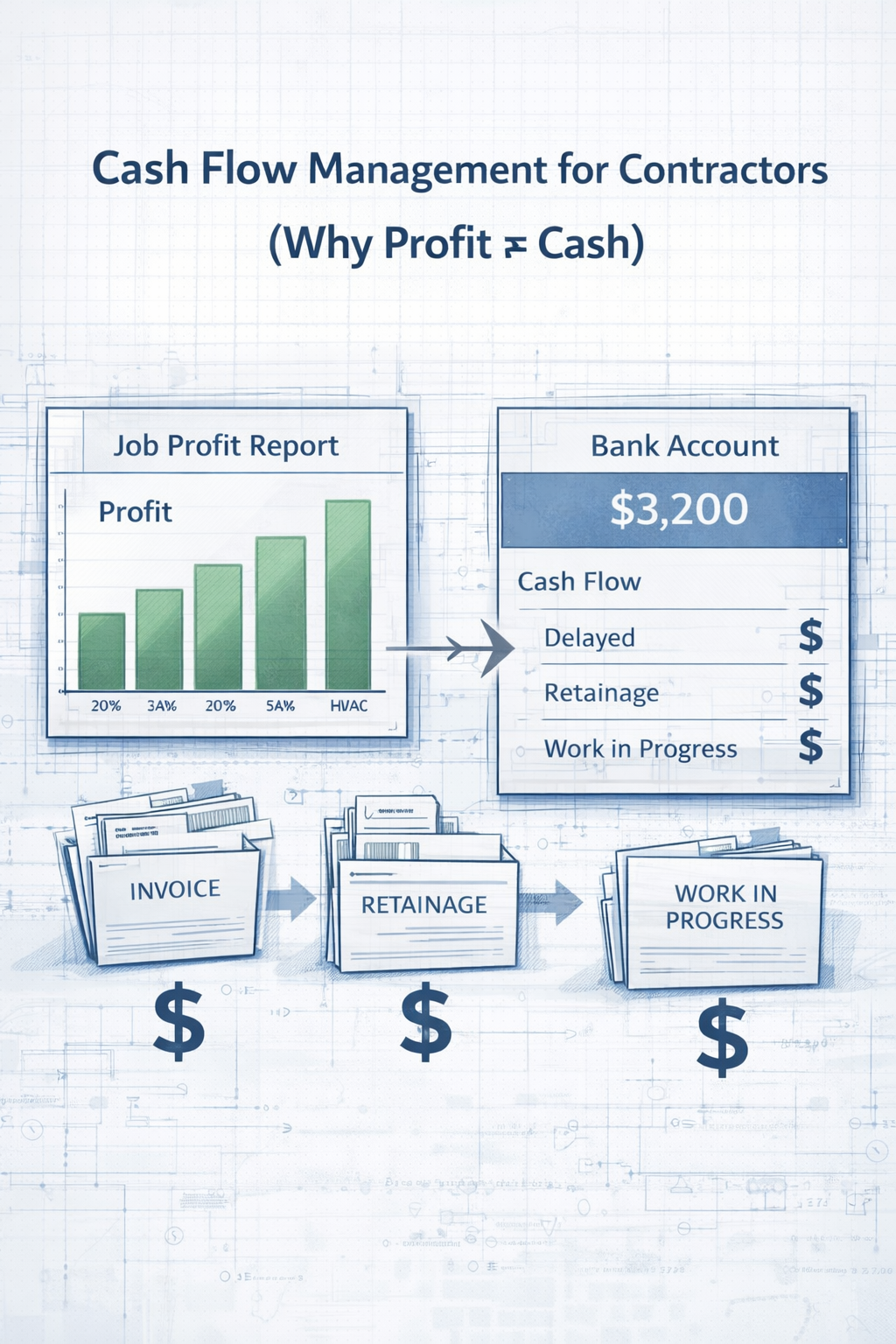

Insider Notes Contractors Learn Late

One large overdue invoice can wipe out the cash buffer from several healthy jobs.

Retainage often hides real cash shortages.

Growth amplifies cash timing problems.

Profit and cash are not the same thing.

If your job cost reports show profit but cash is unstable, revisit:

Job Costing Basics for Trades & Contractors

Cash flow visibility starts with clean job structure.

Real-World Impact

When AR and billing systems are tight:

AR stays under 30 days

Cash stabilizes

Vendor payments are predictable

Credit lines shrink instead of grow

Growth becomes controlled

You gain:

Hiring confidence

Equipment purchase clarity

Better labor planning

Owner compensation visibility

If slow payments are causing recurring strain, the Job Costing Health Report is a practical next step. It helps identify whether billing timing, reporting gaps, or job setup issues are driving the problem.

Cash flow stress is rarely random. It’s usually structural.

Summary: This Isn’t Admin Work — It’s Margin Protection

Slow-paying clients don’t just delay money.

They:

Increase borrowing costs

Force reactive decisions

Hide weak billing systems

Distort job performance visibility

Tight billing and AR systems protect margin. Not because they increase revenue — but because they protect the cash you’ve already earned.

Frequently Asked Questions

-

Yes. Contractors operate on tight cash cycles. Monthly review is usually too slow when payroll and materials are moving weekly.

-

DescriptRun an Accounts Receivable Aging Summary report weekly. Tie invoices to job milestones, not arbitrary dates, and monitor overdue balances consistently.ion text goes here

-

You’ll rely more heavily on credit lines, delay investment decisions, and operate under ongoing cash pressure — even when jobs are profitable.

-

It’s best practice — but for growing contractors, it becomes operationally critical.

-

Item descriptionImmediately. Cash flow issues compound. The earlier billing and AR systems are structured correctly, the faster stability returns.

If labor overruns, reporting confusion, or job cost surprises keep happening, it’s usually a setup and systems issue. Dialing in job setup, billing structure, and reporting early is one of the fastest ways to protect margin.

Disclaimer:

This content is for general educational purposes only and does not constitute tax, legal, or accounting advice. Individual circumstances vary, and tax and reporting requirements can change. Always consult a qualified CPA, tax professional, or legal advisor for guidance specific to your business.