Monthly Close Checklist for Contractors (The Control System Most People Skip)

It’s the 10th of the month. Payroll already hit. Vendors are calling.

You pull reports, but something feels off.

Cash doesn’t match the bank. Job costs look incomplete. Last month’s numbers keep changing.

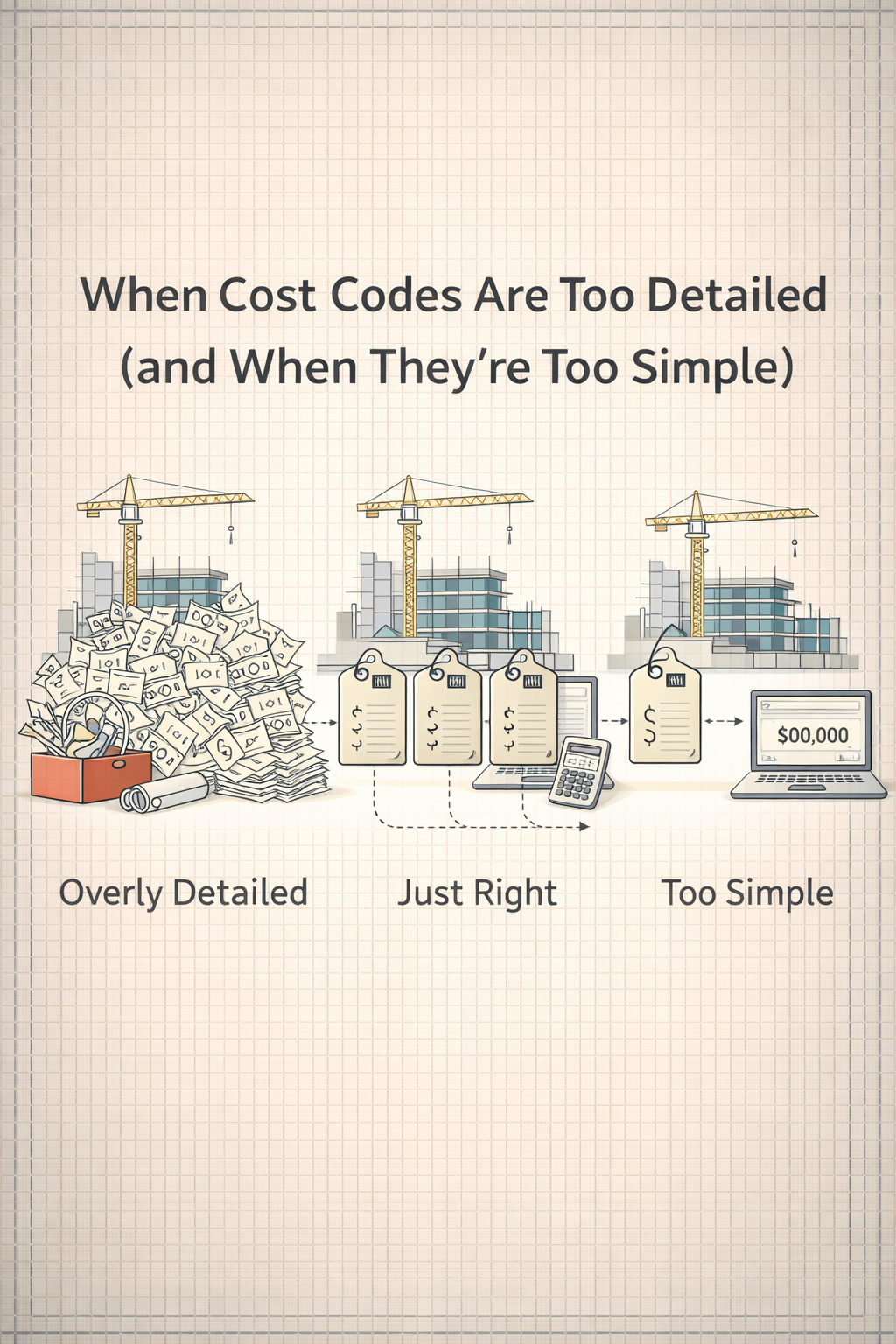

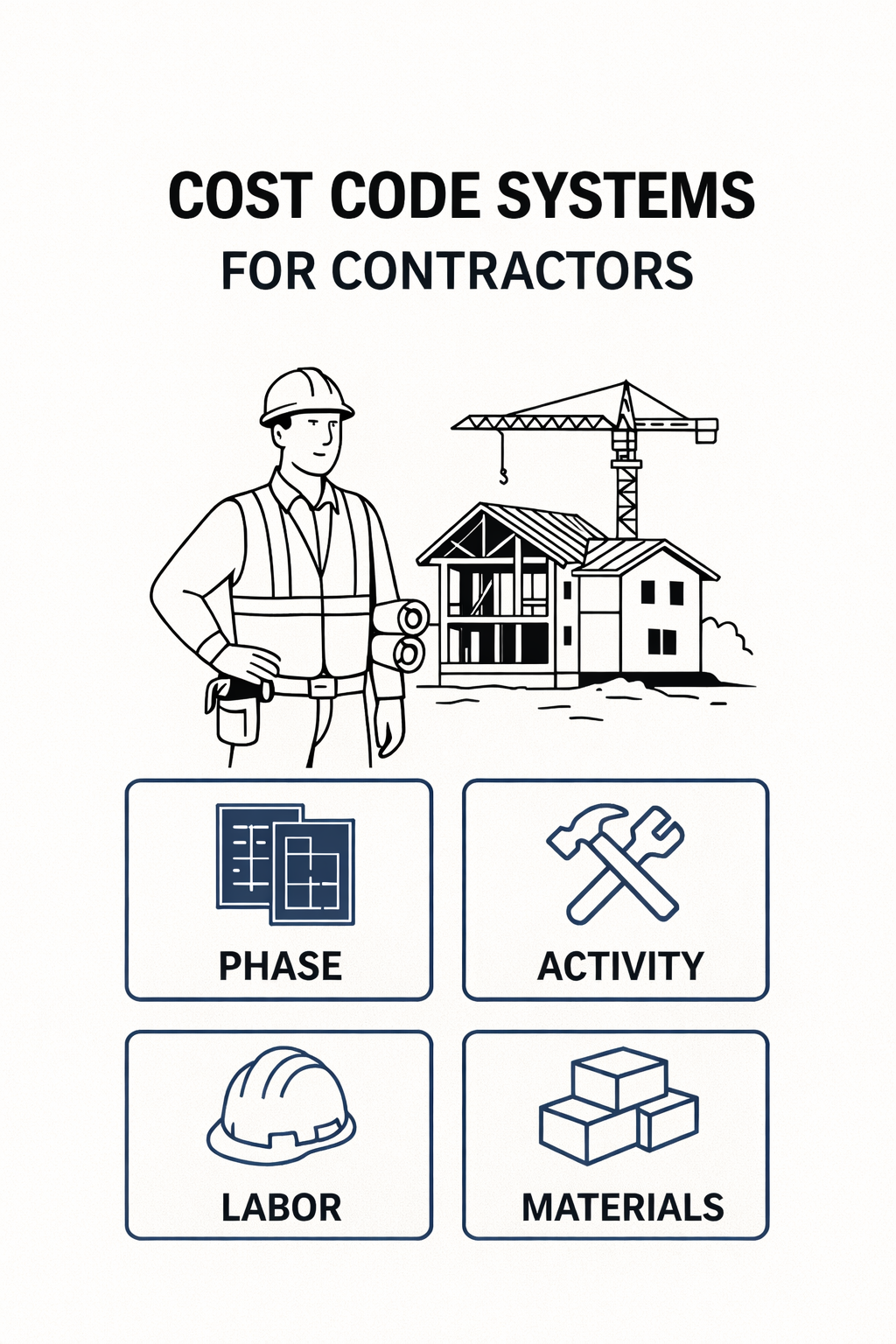

When Cost Codes Are Too Detailed (and When They’re Too Simple)

One contractor sees 30 cost codes for a small remodel and still can’t tell where profit leaked. Another has four total cost codes across every job and wonders why labor always “looks fine” until cash runs out.

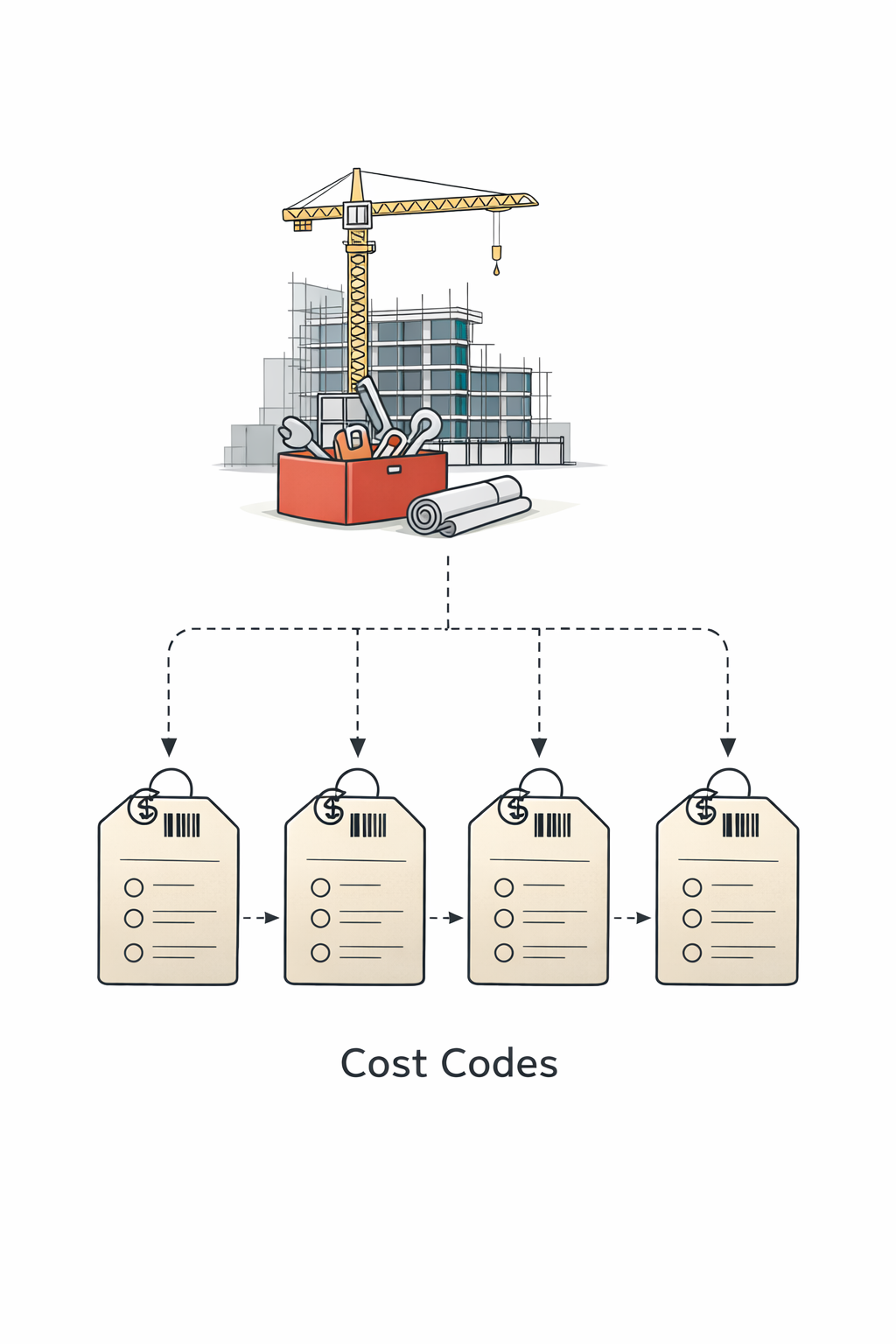

How Contractors Should Set Up Cost Codes in Their Accounting System

A project wraps up. Cash hit the bank. The job felt profitable. But when you try to review labor, materials, and subs by phase, the numbers don’t line up—or worse, everything is lumped into one bucket.

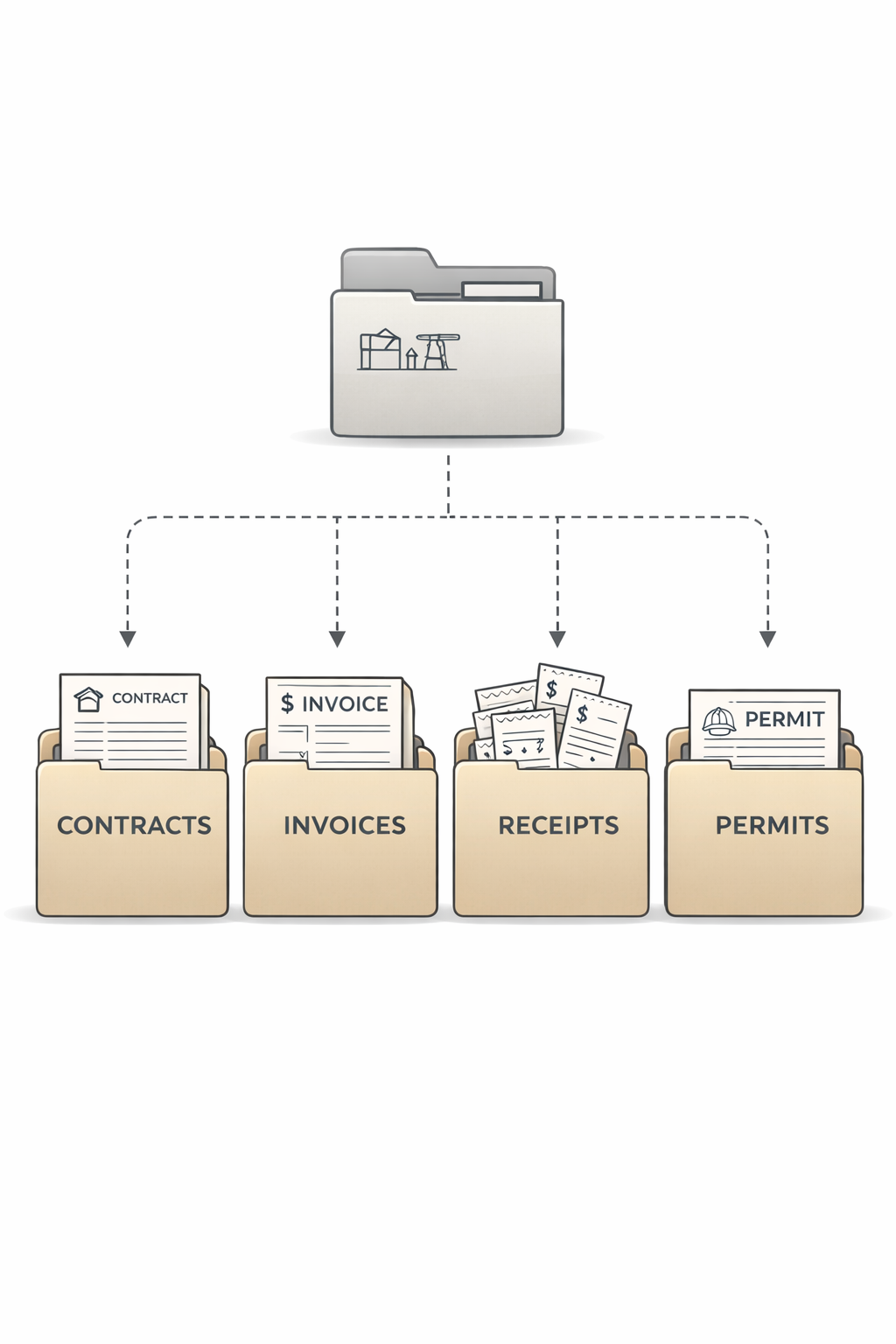

The One Folder Rule That Prevents Accounting Chaos

The invoice came in. The receipt exists. The signed change order was saved. But when payroll hits, or a job review comes up, no one can find the paperwork fast enough to prove where the money went.

How Contractors Should Organize Digital Receipts & Job Documents (So Job Costing Actually Works)

You know the documents exist — emails, texts, photos, QuickBooks attachments — but no one can find the full trail fast.

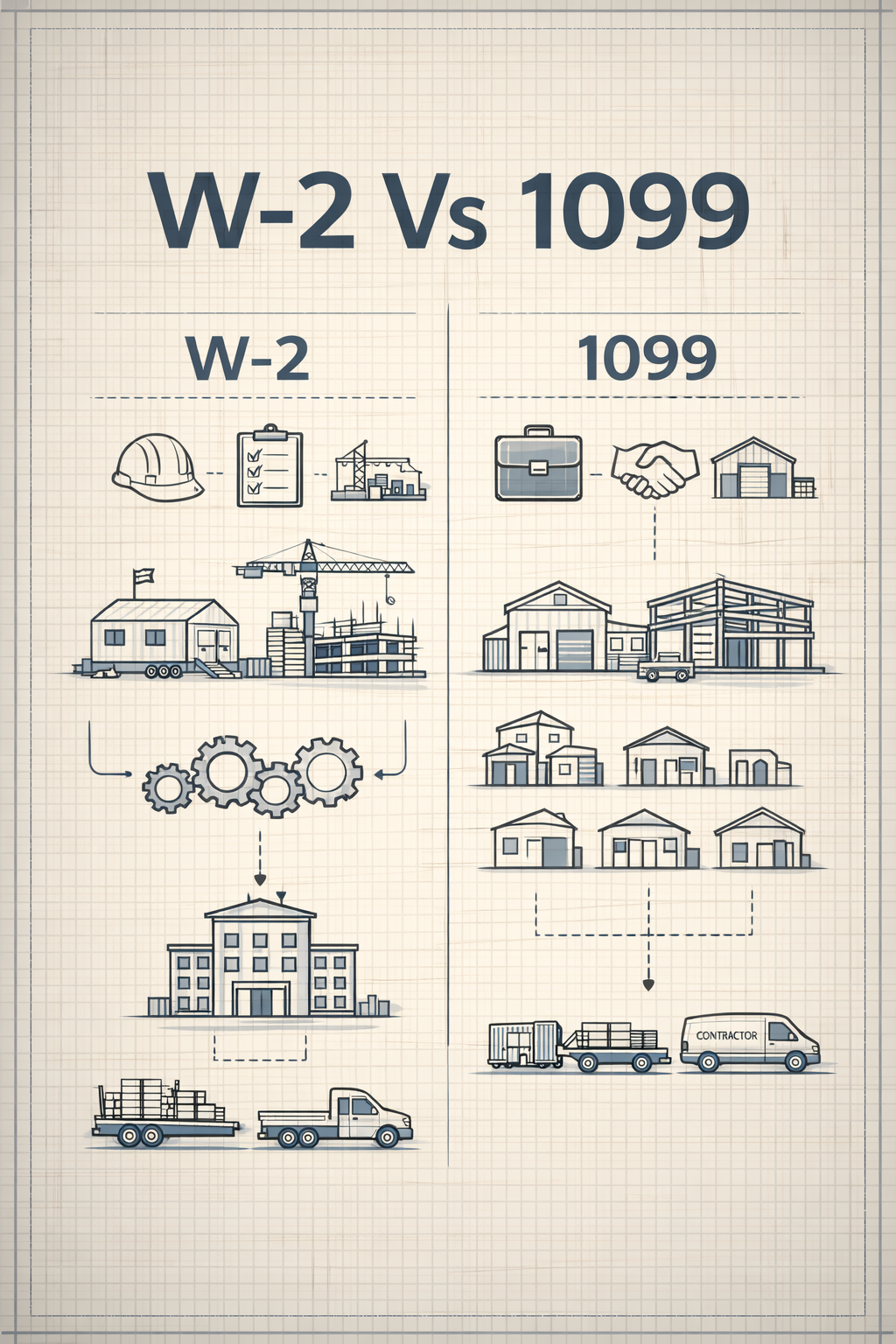

W-2 vs 1099 in Construction: How Contractors Get This Wrong (And Why Short-Term Labor Still Counts)

W-2 vs 1099 in construction isn’t about finding loopholes. It’s about understanding where labor sits on the control–independence spectrum and structuring relationships to match reality.

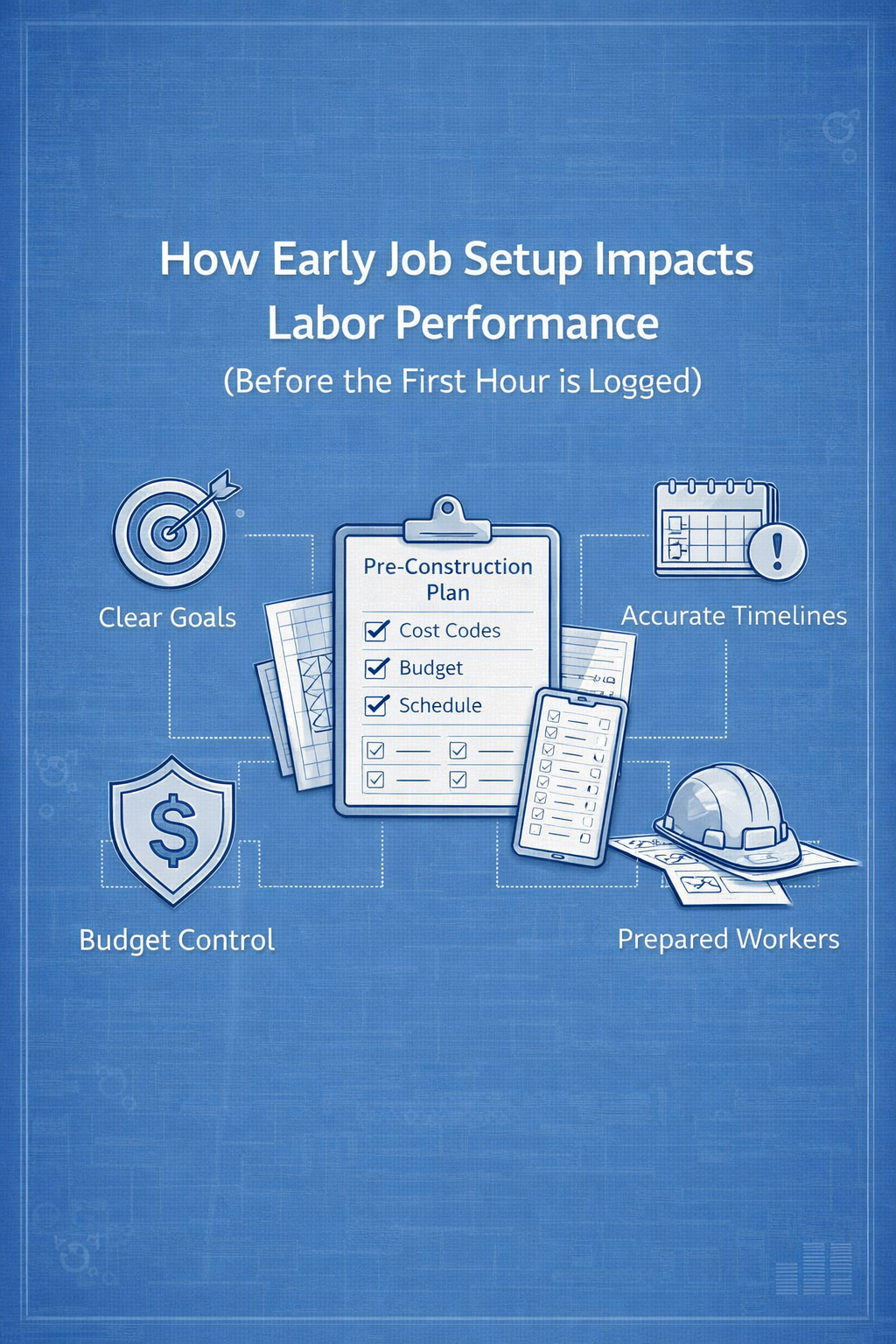

How Early Job Setup Impacts Labor Performance (Before the First Hour Is Logged)

Labor performance problems don’t start in the field—they start at job setup. When labor budgets, cost codes, and payroll mapping aren’t built before the first hour is logged, overruns stay hidden until the job is over. Early job setup is what makes labor performance measurable, visible, and correctable while the job is still running.

Labor Tracking & Payroll Allocation for Contractors

Labor is the number one reason contractors lose money on jobs — not materials or subs. The problem isn’t effort, it’s visibility. In this guide, we break down a simple system for tracking labor by job, phase, and cost code, explain why payroll works differently in construction, and show how understanding true labor cost helps you protect profit before a job slips.

How to Build a Cost Code System for Your Trade

Learn how contractors can build trade-specific cost codes that improve job costing, invoice coding, labor tracking, and service profitability. A clear framework to create consistent cost codes for construction, trades, and remodeling companies.

Contractor Invoice Approval Workflow

How contractors can set up a simple invoice approval workflow to verify invoices, assign cost codes, prevent job costing errors, and keep accounting clean. Includes steps, roles, and folder structure.

Vendor Invoice Tracking for Contractors

A clear, step-by-step system for contractors to capture, organize, and process vendor invoices without losing receipts, missing write-offs, or destroying job costing accuracy. This guide shows trades and construction businesses exactly how to collect invoices in real time, route everything to one inbox, store documents correctly, and build a simple workflow that keeps accounting clean, protects profitability, and scales as the business grows.

Job Costing Basics for Trades & Contractors.

Job costing is the backbone of every profitable contracting business — yet most contractors still rely on “guess costing,” hoping their labor, materials, and subs come close to the estimate. This article breaks down the four pillars of job costing and gives you a simple, repeatable system to track project costs, protect your margins, and scale your business with confidence.